Contents:

Traders may use Fibonacci ratios as a tool to help determine optimal entry points into markets. The defined period for the standard deviation is exactly the same as the simple moving average. For traders, VWAP can be used as an important guidepost in gauging whether the price of a security is trading above or below fair value based on current volume levels.

Will Cannabis Stocks Rally In April? 3 To Watch This Month – InvestorsObserver

Will Cannabis Stocks Rally In April? 3 To Watch This Month.

Posted: Sun, 02 Apr 2023 16:06:44 GMT [source]

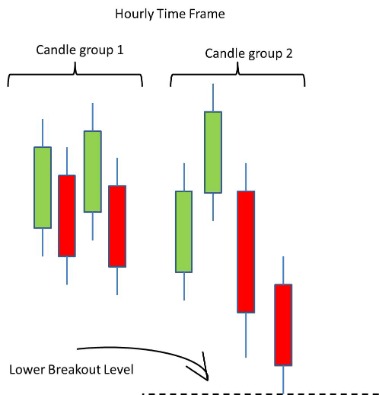

Strategies based on determining the moments when the trend exits the average range, which could signal the following trend reversal. Analysis of the longer timeframes to define the volatility level and switch to a shorter timeframe. It is often used in daily timeframes in the strategies, which imply trading in H1-H4 timeframes. SMA – the arithmetic average of the closing prices for the period specified in the settings. In short timeframes, there are many false signals because of the lack of a clear trend. It is suitable for traders with a certain degree of experience who can distinguish between true and false signals of oscillators.

How Technical Analysis Indicators Work

The best technical indicators for short term trading indicator Williams %R is a trading indicator that measures the trading price relative to trading volume. A pivot trading indicator is a trading indicator that points out support and resistance trading levels based on the previous day’s trading action. Directional Movement is a major trading indicator that traders use to determine where trading prices will go in the future.

This means that you could lose more than 5x the amount of your deposit. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend.

Pick The Highest VST And Win Your Trades

Think of it as partly similar to the OBV indicator, however, instead of considering the opening price; the calculation only puts into account the closing price. An addition is the use of the trading range as the trading duration, and where the closing price should be a price near that range. As a short-term trader, you can either be a scalper, swing trader, or day trader. The stock market has restrictions on trading hours, and there’s usually less volatility when you trade outside those hours. If your market timing is not precise and the price moves away from the direction you anticipated, you’re at significant risk of incurring losses. Day trading strategies are usually more productive in volatile markets like oil trading.

Here’s Why Aptinyx Inc. (APTX) Is a Great ‘Buy the Bottom’ Stock Now – Yahoo Finance

Here’s Why Aptinyx Inc. (APTX) Is a Great ‘Buy the Bottom’ Stock Now.

Posted: Thu, 30 Mar 2023 13:55:01 GMT [source]

Please, ensure you dedicate enough time to learning and practicing short-term trade on your demo account before going live. A market that’s going upward will attract more market traders, which may cause the price to increase. In contrast, a fall in market price discourages market players, thereby causing a price decrease. In my trading, I use an SMA because it allows me to stay in trades longer as a swing trader. An RSI value over 70 signals that the asset may be overbought, while RSI under 30 points to oversold. Momentum indicators can give you additional clues to put the odds of being correct even more in your favor.

Whereas a currency pair that does not fluctuate as much is said to have low volatility. It’s important to note how volatile a currency pair is before opening a trade, so we can take that into consideration by picking our trade size and stop and limit levels. Relative Strength Index is the most popular oscillator to use. A big component of its formula is the ratio between the average gain and average loss over the last 14 periods. The RSI is bound between 0 – 100 and is considered overbought above 70 and oversold when below 30. Traders look to sell when 70 is crossed from above and look to buy when 30 is crossed from below.

Best Indicators for Crypto Trading

When in doubt, remember that every https://g-markets.net/r uses different indicators. It’s up to you to find the ones that are most effective for your trading strategy and that help rather than hinder your trading. The default settings for RSI are using 14-days but dropping down to lower timeframes like the one-hours chart will produce an RSI constructed using 14 hours of price data instead.

Moving averages are widely used technical indicators that work on a simple formula of averages of the closing prices of past trading sessions. Thus these trend indicators majorly are to observe the trend performance over a period of time. This means trend indicators are majorly used by the mid to long-term traders, for observing a trend of the larger time frames. If you’re a beginner then obviously the word Technical Indicator itself must be overwhelming to you.

Assess Overall Market Conditions With Ease

Moving Averages are among the best forex indicators for beginner traders. The calculation formula is simple, the interpretation of the signals is straightforward. Try various parameters for different types of MA, and you will understand how to develop and optimize simple trading systems. Because of lagging, there are quite many false signals in scalping and strategies based on fundamental analysis.

Pivot points consist of a central pivot and three supporting pivot levels below it and three resistance pivot levels above it. These levels can be used as entry or exit points for trades based on whether the market is trending up or down. A Fibonacci retracement uses key Fibonacci levels as support and resistance before it continues in the original direction of a trend.

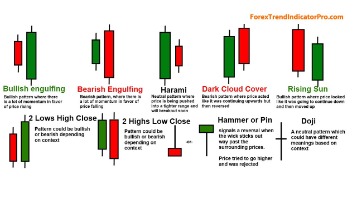

Now, let’s take a look at what a candlestick looks like. P/E ratio -At its most rudimentary level,P/E ratios (price/earnings) are a simple way for investors to gauge how expensive an equity is. A P/E ratio is calculated by dividing the share price by its annual earnings per share.The figure demonstrates the amount of money you are paying for each $1 the company earns. This means that you are paying $25 for every $1 of Apple’s earnings.The lower the P/E ratio, the cheaper the stock is in comparison to the amount of money that company has earned. As a result,one of the most significant limitations of technical analysis is that it relies on the subjective interpretations of each individual trader. Adding more indicators that supply the same information to a chart will not make them more reliable.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

This can be interpreted as a change in the market’s momentum, which could lead to a change in the price trend. For example, traders are advised to avoid using a momentum indicator suited for sideways markets when a market is trending. As with any strategy or indicator that is new to you, we recommend testing them out in the simulator first. This way, you’ll learn how to set your charts properly, and know which trading indicators work best for your strategies.

Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Which gives you access to all the functionality needed to learn technical analysis. The ATR shows how volatility moves up and down, confirming the best signals when volatility is low and about to pick up. Volume indicators tally up trades and quantify whether bulls or bear are in control. The indicator is a running total of up volume minus down volume.

The longer the duration on each MA gives more weighting but also decreases sensitivity because with increasing time there will be fewer periods during which change can occur. It uses historic price, volume and open interest information to forecast what direction the financial asset is going. This underlying knowledge can help a trader identify trading opportunities. Momentum oscillators are a class of several technical indicators that measure an asset’s price momentum. Two of the most popular momentum oscillators are the relative strength index and the stochastic oscillator. For example, a simple technical indicator is a moving average.